|

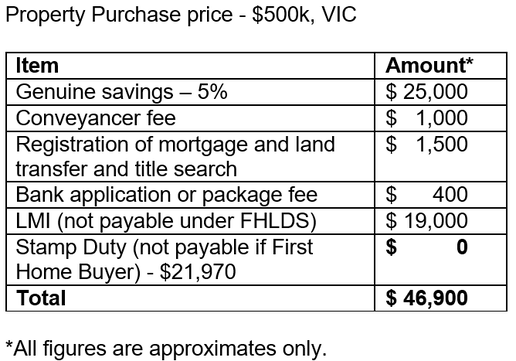

Buying your first home is very exciting. It is a big step and a huge financial commitment, so you want to get it right. Without a doubt the question I get asked the most from First Home Buyers is how much do I need to save? Everyone's situation is completely different and I am always happy to chat to you over Zoom or the Phone and discuss your unique situation. I can do some calculations for you based on how much you earn and your existing debt and expenses. But in the meantime, as a summary, here are some of the more important things to consider when saving to buying your first home: 1. You will need at least 5% of the price of the property in savings. On a $500k property that will mean you need to have at least $25k in savings. 2. Your savings need to be in your bank account for three months minimum. Savings cannot be a lump sum or gift, it needs to be gradual savings that you have had in your account for at least 3 months when you apply. This shows the lender that you can save and therefore could repay a loan. Some lenders may allow you to show rental history as quasi ‘savings’. 3. Have enough additional funds to cover fees On top of the 5% you need there will be all sorts of fees – Government registration fees, title searches, bank application or package fees and Conveyancer fees. There may also be valuation fees and settlement fees. 4. The killer is LMI The big fees are for Lenders Mortgage Insurance (LMI). If you borrow over 80% of the value of the property you have to pay this. Some lenders will allow you to capitalise (add this amount to the loan) but your interest rate will be higher. The only way to avoid this is by having a Guarantor (maybe a parent has a property they can use as security?). There has also been a recent Government initiative whereby the Government becomes the ‘Guarantor’ and LMI was not require. This was called the First Home Loan Deposit Scheme (FHLDS) – unfortunately this has finished for 2020, there were 20,000 spots allocated. They may run this program again next year, it's hard to know. I can keep you informed in you are interested as this scheme provided substantial savings as you will see in the Calculations below. Here is an example of what you need to purchase a $500k home in Victoria. So all up to buy a $500k property you will need from $47k to over $69k (if you are not a First Home Buyer). As you can see the FHLDS is a significant saving.

Also worth noting is that the more you contribute the cheaper the interest rates will be. Repayments on $475k at 3% (estimate) are approx. $2,003 per month or $462 per week. Rates can range from 1.99% (Fixed Rate P&I) to 4.62% (Variable 98% lend P&I) so interest rates can vary hugely depending on your situation. My services are free as I am paid through the lender. So don't be afraid to ask me lots of questions. It is complicated so I am here to help. I can also take your through the various Government initiatives for First Home Buyers, some of which can save you a lot of money. There are First Home Buyer Grants, Home Builder Grants, First Home Loan Deposit Schemes and Stamp Duty Exemptions and Concessions. Some are Federally but most are State based and different for each state. I can guide you through these as well as the eligibility criteria. No question is a silly one but I do hope this give you a little insight into what or how much is required. Next time I will cover off on how much you can I borrow - the second most asked question I get! In the meantime let us work together to help you make your home ownership dreams come true. Catherine Thompson Principal, Volare Home Loans Mobile: 0411 849 804

1 Comment

If you are a small or medium business owner, you probably aren’t in meaningful regular contact with your accountant. Instead, your relationship is occasional, and any communication will be limited to your accountant providing the latest financial statements for your business. The balance sheet and profit and loss statements will be given a glance, but you won’t delve into them any more in-depth than you need to – that is the accountant’s job, and you are busy running your business. This is a common scenario that plagues small business. It may very well mean you lack the financial insights to steer your company in the right direction.

If you understand the importance of being on top of your finances in achieving business success, the first step to making a change is to develop an understanding of your financial statements. Once you have analysed the statements your accountant provides to the best of your ability, it is a great idea to set up a conversation with them to follow up with some key questions. Understanding these eight essential questions will go a long way in cementing your knowledge of your company’s financial position. 1. What is my gross profit margin? The gross profit margin is an important metric to measure how much profit you are making from each sale you make. Gross profit subtracts the cost of goods sold from your topline sales number. Dividing your gross profit by sales produces the gross profit margin. A higher margin is usually better as it indicates you are making more money per dollar of sales. Keep in mind that it does not take into account any other costs. However, it does give you a baseline metric to measure any efforts to boost your income. 2. What is the business’ breakeven point? One of the most important pieces of financial information you need to identify is your break-even point. This is the point where your business is not running at a loss, yet not turning a profit either. Ideally, you will always stay above this point (profitability). The first step to consistently being profitable is understanding where the break-even point is and then taking action to achieve, and then exceed it. 3. How can I boost my business’ cashflow? Cashflow is much more important than many business owners realise. Even if you achieve profitability, it does not mean you are in the clear. Unless you have the cash to meet your bills when they fall due, pay your staff when they’re owed or take advantage of growth opportunities when they arise then your business will not be able to achieve its full potential. “Discuss your cashflow position – it’s more important than you realise” Discuss your cashflow position with your accountant. If you have a lot of unpaid invoices on your books or a history of late-paying customers, you may need to make some changes. They might also recommend a service such as invoice financing to help unlock cash from your account receivable ledger. 4. What is our net profit, and what does that tell us? Once you understand your sales, gross profit margin and break-even point, diving deeper into your net profit figure numbers are useful. Net profit takes your revenue and subtracts all the other costs involved in running your business, including staff, rent and taxes. Net profit is a holistic measure to assess how economical your business is over a specified period. It’s a great tool to establish opportunities for improvement. For example, if your gross profit margin is industry-leading, yet your net profit is negative, then it may be a sign you are carrying too many unnecessary operating expenses. The benchmark level of net profitability varies depending on your industry, so check this with your accountant also. 5. Which areas of the business are most profitable? If you have multiple products or service lines, you’ll know that some perform better than others. The products you generate the most revenue from are not necessarily the most profitable. Once you identify which areas of your business are the most profitable, you can begin to develop a plan to boost sales of the right products or services. The insights your accountant can deliver here may make a significant difference to the strategy and direction of your business. 6. I want to cut expenses, where should I cut? As we have seen recently, there will be times when we need to cut costs urgently. When this occurs, it can often be challenging to know where to prioritise. Your accountant will be able to give you insights into where you can save the most bang for buck. They will be able to benchmark your expenses to your competitors, helping you identify opportunities. 7. How long can we survive if things go bad (again)? In addition to cutting costs, it helps to know how well your business would be able to weather the storm. Will you still be profitable if sales were to fall 50% (or more)? Your accountant can help you identify financial risks and advise you of funding options that would be appropriate for your company, helping you find solutions to survive a tough period. 8. How am I doing compared to my competitors? If you want to compete effectively, you need to understand how you are performing relative to your competitors. If you are underperforming across multiple metrics, you need to investigate why – there is almost always an opportunity for improvement. Ask your accountant what they think you can do to catch up and move ahead of other businesses in your industry. Once you understand your financial position, you’ll be better placed to take advantage of growth opportunities and take your business to the next level. Don’t let a lack of cash flow hold your business back. Speak to me, your broker and let me assist you with any of your funding needs. One-eighth of all first home buyers who purchased a home between March and June 2020 did so using the First Home Loan Deposit Scheme, a new report shows. Roughly 12.5% of all homes purchased by first home buyers during the pandemic's peak months were done so utilising the scheme, according to the scheme's administrator the National Housing Finance and Investment Corporation (NHFIC). The first home loan deposit scheme (FHLDS) was launched on January 1 2020 by the Federal Government to help first home buyers secure a home loan with a deposit as little as 5% while avoiding the high cost of Lenders Mortgage Insurance (LMI). A new report by the NHFIC said the scheme has supported many younger buyers, but also some older cohorts. "The Scheme has had broad geographical reach supporting first home buyers across the country with strong interest from buyers in outer metropolitan and regional areas," the report said. "First time buyers have been able to bring forward their home purchases in line with the objectives of the Scheme. FHLDS has now cemented itself as part of the first home buyer support policy architecture." The scheme may have helped increase first home buyers' share of the market, with CoreLogic's head of research Eliza Owen last week reporting first home buyers made up 29.5% of all owner-occupier commitments in June, far above the 23.2% decade average. "The expansion of the first home loan deposit scheme and other first home buyer incentives announced over June and July is likely to see a boost in first home buyer participation over the second half of 2020," Ms Owen said. Article by William Jolly on August 31, 2020

https://www.savings.com.au/home-loans/buying-first-home/first-home-loan-deposit-scheme-supporting-1-8-of-all-first-home-buyers |

Message from CAtherineOccasionally I come across an interesting article to do with Home Loans. I thought I'd share some of these with you here. Archives

November 2023

Categories |

Proudly powered by Weebly

RSS Feed

RSS Feed